Understanding Compound Interest: A Powerful Financial Tool

Understanding Compound Interest: A Powerful Financial Tool

Introduction:

Compound interest is a concept that has a profound impact on personal finances and investment strategies. It plays a crucial role in helping individuals accumulate wealth over time. By understanding how compound interest works, you can make informed financial decisions and harness its power to your advantage. This article aims to explain the fundamentals of compound interest and its implications for your financial future.

1. The Basics of Compound Interest:

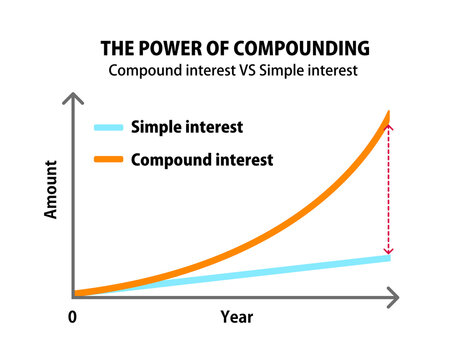

Compound interest is the interest earned on both the initial principal amount and the accumulated interest from previous periods. Unlike simple interest, which is calculated only on the initial investment, compound interest allows your money to grow exponentially over time. It is commonly employed in savings accounts, certificates of deposit, bonds, and various investment vehicles.

2. The Power of Time:

One of the key factors that make compound interest so potent is time. The longer your money remains invested, the more it can benefit from compounding. The effects of compound interest may not be immediately noticeable, but given enough time, they can lead to substantial growth. Therefore, starting early and allowing your investments to compound over a longer period can significantly enhance your financial well-being.

3. Compound Interest Formulas:

To understand how compound interest is calculated, two formulas are commonly used: a. Future Value Formula:

Future Value (FV) = P * (1 + r/n)^(n*t) In this formula, P represents the principal amount, r denotes the annual interest rate (expressed as a decimal), n represents the number of compounding periods per year, and t signifies the number of years. b. Compound Interest Formula:

Compound Interest (CI) = FV - P The compound interest is calculated by subtracting the initial principal amount from the future value.

4. Compounding Frequency:

The frequency at which interest is compounded can significantly impact your investment growth. When interest is compounded more frequently, such as quarterly or monthly, it results in higher overall returns. This is because compounding occurs more frequently, allowing your money to earn additional interest on a more regular basis. Therefore, it's advisable to choose investments that compound interest more frequently to maximize your returns.

5. The Rule of 72:

The rule of 72 is a handy rule of thumb for estimating the time it takes for an investment to double with compound interest. By dividing 72 by the annual interest rate, you can approximate the number of years required for your investment to double. For example, if your investment earns an annual return of 8%, it would take approximately 9 years for it to double (72 ÷ 8 = 9).

6. Harnessing Compound Interest:

To make the most of compound interest, consider the following strategies: a. Start Early: The earlier you begin investing, the longer your money has to grow through compound interest. b. Stay Invested: Avoid unnecessary withdrawals and allow your investments to compound undisturbed over time. c. Increase Contributions: Regularly adding to your investments can accelerate the growth of compound interest. d. Seek Higher Interest Rates: Look for investment options with competitive interest rates or explore higher-yield investments to maximize your returns.

Conclusion:

Understanding compound interest is essential for anyone aiming to build wealth and achieve financial goals. By grasping its fundamental principles and utilizing the power of time and compounding, you can leverage compound interest to your advantage. Whether you're saving for retirement, education, or other financial aspirations, compound interest can serve as a powerful tool in realizing your long-term objectives. Start harnessing the power of compound interest today and set yourself on the path to financial success.

Comments

Post a Comment