The Pros and Cons of Investing in Index Funds: A Comprehensive Analysis

Introduction:

Index funds have gained significant popularity among investors as a passive investment strategy. These funds aim to replicate the performance of a specific market index, such as the S&P 500, by holding a diversified portfolio of securities. While index funds offer several advantages, they also have their drawbacks. This article explores the pros and cons of investing in index funds, helping you make an informed decision about whether they are the right investment choice for you.

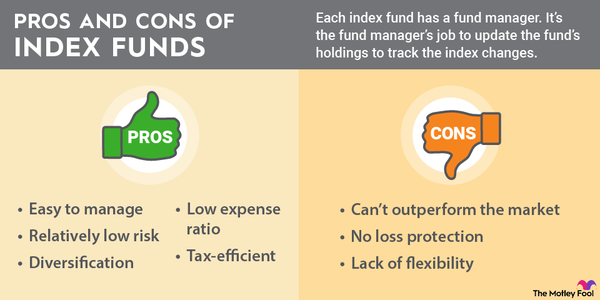

Pros of Investing in Index Funds:

1. Broad Market Exposure:

Index funds provide investors with instant diversification across a broad market. By holding a basket of securities that mirrors the composition of an index, such as large-cap stocks or bonds, investors gain exposure to numerous companies or bonds within a single investment. This diversification helps mitigate the risk associated with investing in individual stocks or bonds.

2. Low Costs:

Compared to actively managed funds, index funds generally have lower expense ratios. Since index funds aim to replicate the performance of an index rather than outperform it, they require less active management and incur fewer transaction costs. Lower expenses can have a significant impact on long-term returns, especially when compounded over many years.

3. Consistent Performance:

While index funds may not outperform the market, they also tend to avoid underperforming it significantly. The goal of an index fund is to closely track the performance of its benchmark index. By doing so, index funds provide investors with consistent returns that are in line with the overall market performance. This predictability can be reassuring for long-term investors.

4. Simplicity and Accessibility:

Investing in index funds is relatively straightforward, making it accessible to both novice and experienced investors. They offer a simple investment strategy, as investors don't need to research individual stocks or make frequent buying and selling decisions. Additionally, index funds are available through various financial institutions and brokerage platforms, making them easily accessible to a wide range of investors.

Cons of Investing in Index Funds:

1. Limited Potential for Outperformance:

While index funds provide reliable market returns, they often do not outperform the market. Since index funds aim to replicate the performance of an index, they are not designed to beat the market. This means that investors may miss out on the potential for significant gains that could be achieved by actively managed funds or individual stock investments.

2. Lack of Flexibility:

Investing in index funds means accepting the predetermined composition of the index. This lack of flexibility can be a disadvantage if certain sectors or companies within the index are underperforming or if there are specific investment preferences or goals that are not reflected in the index's composition. Active investors who want control over their investment choices may find index funds too restrictive.

3. Market Volatility Exposure:

Index funds are passively managed and aim to replicate the performance of the market index they track. As a result, investors in index funds are exposed to market volatility. During periods of market downturns or increased volatility, index funds will generally experience declines in value. This can be a concern for risk-averse investors who prioritize capital preservation.

4. Lack of Personalized Approach:

Index funds provide a one-size-fits-all investment strategy, which may not align with an individual investor's specific financial goals or risk tolerance. Investors with unique circumstances or specific investment preferences may find that index funds do not meet their needs. In such cases, seeking professional financial advice or considering a more tailored investment approach may be more suitable.

Conclusion:

Investing in index funds offers a range of benefits, including broad market exposure, low costs, consistent performance, and simplicity. These factors make index funds an attractive option for many investors, particularly those seeking a passive investment approach with minimal effort. However, it's essential to consider the limitations, such as limited potential for outperformance, lack of flexibility, exposure to market volatility, and a lack of personalized approach. Before investing, it is crucial to evaluate your financial goals, risk tolerance, and investment preferences to determine if index funds align with your overall investment strategy.

Comments

Post a Comment