5 Essential Tips for Building an Effective Budget

Introduction:

Creating a budget is a fundamental step towards achieving financial stability and reaching your financial goals. An effective budget helps you take control of your finances, track your spending, and make informed financial decisions. This article presents five essential tips to help you build a budget that works for you and sets you on the path to financial success.

1. Set Clear Financial Goals:

Before diving into budgeting, it's important to establish clear financial goals. Whether you aim to pay off debt, save for a down payment, or plan for retirement, having specific goals provides direction and motivation. Identify your short-term and long-term financial objectives to guide your budgeting decisions effectively.

2. Track Your Income and Expenses:

To build an effective budget, start by tracking your income and expenses. Calculate your total monthly income from all sources, including salaries, bonuses, and side hustles. Then, record and categorize your expenses, such as housing, transportation, groceries, and entertainment. Use budgeting apps or spreadsheets to streamline the process and gain a comprehensive view of your financial inflows and outflows.

3. Differentiate Between Needs and Wants:

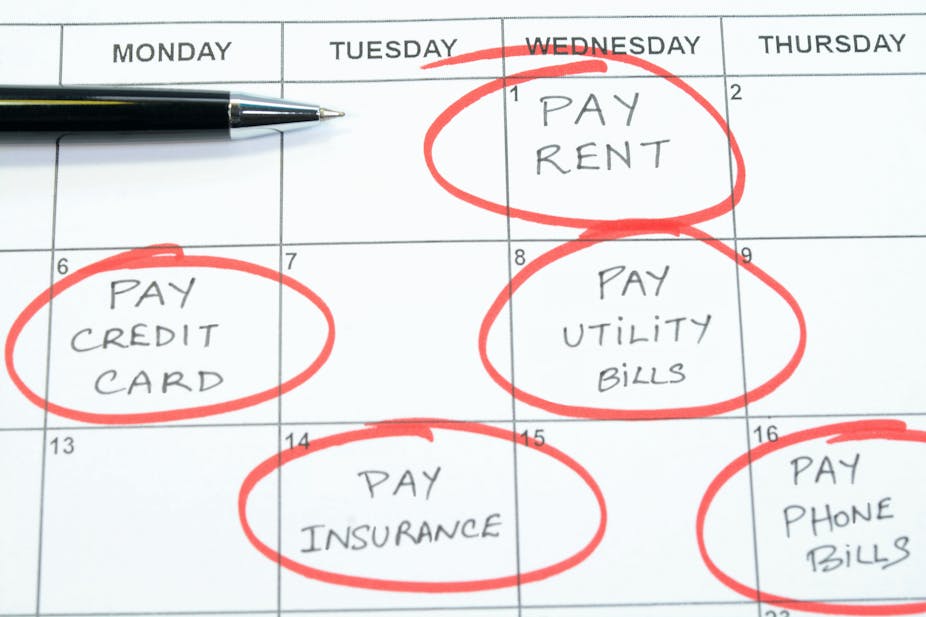

Distinguishing between needs and wants is crucial for effective budgeting. Analyze your expenses and identify essential needs, such as rent, utilities, groceries, and debt payments. Differentiate them from discretionary expenses, such as dining out, vacations, and shopping. Prioritize your needs and allocate funds accordingly, while being mindful of your discretionary spending to avoid unnecessary financial strain.

4. Create Realistic Spending Categories:

When building your budget, create realistic spending categories that align with your financial goals and lifestyle. Allocate appropriate amounts to each category, considering factors like income, debt obligations, and savings targets. Strive for a balance between essential expenses, savings, and discretionary spending to ensure your budget is sustainable and flexible.

5. Regularly Review and Adjust:

Building an effective budget is an ongoing process. Regularly review your budget and track your progress towards your financial goals. Evaluate any deviations from your initial plan and adjust your budget accordingly. Life circumstances and financial priorities may change, requiring you to adapt your budget to accommodate new goals or unforeseen expenses. By regularly reviewing and adjusting your budget, you can ensure it remains relevant and effective.

Conclusion:

Building an effective budget is essential for taking control of your finances and achieving your financial aspirations. By setting clear goals, tracking your income and expenses, differentiating between needs and wants, creating realistic spending categories, and regularly reviewing and adjusting your budget, you can gain financial stability and make informed financial decisions. Remember, building a budget is a personalized process, so customize it to fit your unique circumstances and goals. Start implementing these essential tips today and pave the way towards a healthier financial future.

Comments

Post a Comment